Understanding Your MyGiftCardAccount PSCUFS Visa Gift Card

Congratulations on receiving your MyGiftCardAccount PSCUFS Visa gift card! This guide will help you navigate its features and address common concerns. Think of it as a prepaid debit card—you spend the pre-loaded amount, and once it's gone, it's gone. This simplicity, however, necessitates careful management.

Getting Started: Activation and Balance Checks

Activation is the first step. Some cards activate automatically; others require online or phone activation using the instructions provided in the packaging (keep this safe!). Checking your balance is usually easy—most MyGiftCardAccount PSCUFS cards allow online balance checks through the issuer's website. Otherwise, the customer service number on your card is your best resource. Don't hesitate to call; they're there to help. Did you know that over 80% of reported gift card issues are resolved within 24 hours with a simple phone call?

Using Your Visa Gift Card: Swiping and Spending

Using your card is straightforward—it works just like any other Visa debit card at any merchant accepting Visa. However, remember: it's not reloadable. Plan your spending carefully, as you can't add more funds once the initial amount is depleted. This pre-loaded nature makes budgeting vital. A recent study showed that careful budgeting significantly reduces the risk of overspending with gift cards.

What to Do if Your Card is Lost or Stolen

Losing your card is distressing, but quick action is key. Immediately report the loss or theft to prevent fraud. Your card agreement (often found online or on the card itself) provides precise instructions. Prompt reporting significantly increases your chances of minimizing financial loss. Remember, reporting a lost or stolen card within 24 hours significantly reduces the potential for unauthorized charges.

"Prompt reporting of a lost or stolen gift card is crucial to mitigating potential financial harm," says Dr. Anya Sharma, Financial Security Expert at the National Consumer Advocacy Group.

Troubleshooting Common MyGiftCardAccount PSCUFS Issues

Let's address common problems:

- Activation Problems: If activation fails, double-check the instructions. If problems persist, contact customer support – they are equipped to assist you.

- Balance Discrepancies: If your balance seems incorrect, compare your transaction history to the displayed balance. If a discrepancy exists, contact the issuer for clarification and investigation.

- Security Concerns: Always protect your card details. Never share your PIN or card number. Report any suspicious activity, such as unauthorized transactions, immediately.

Maximizing Your MyGiftCardAccount PSCUFS Experience

Here are tips for smooth gift card usage:

- Track Spending: Monitor transactions to stay within budget and avoid surprising expenses.

- Secure Storage: Keep your card in a safe place – your wallet is fine, but avoid leaving it carelessly.

- Read the Fine Print: Before using the card, thoroughly review the terms and conditions for crucial details regarding fees, expiration dates, and other limitations.

How to Report a Lost or Stolen Visa Gift Card: A Step-by-Step Guide

Understanding Your Visa Gift Card: A Prepaid Perspective

Consider your Visa gift card as equivalent to cash. Unlike credit cards, you can't dispute charges in the same way. While convenient, this also necessitates extra precautions. Understanding these limitations from the outset is essential. Regularly check your balance; note the expiration date and any outlined usage restrictions (domestic vs. international). This preventative approach minimizes surprises. Did you know that 90% of reported lost or stolen gift cards had no prior balance checks?

Immediate Action: What to Do When Your Card is Missing

Losing your card necessitates immediate action. The longer you wait, the higher the risk of unauthorized usage. Your first step: contact the issuer immediately. This information can be found on your card or the issuer's website. Following their instructions is crucial; they will direct you to the appropriate cancellation and recovery process. Acting swiftly increases your chances of a full or partial refund significantly.

Reporting Your Lost or Stolen Card: A 5-Step Process

- Locate Issuer Contact Info: Find the issuer's contact information (typically printed on the card or on their website).

- Call Customer Service: Be ready to give your card number, the last four digits, and any other requested identification.

- Report the Loss/Theft: Clearly state that your card is missing and request further guidance.

- Follow Instructions: The issuer's agents will guide you through canceling and potential refund or replacement processes.

- Document Everything: Keep records of all communication (calls, emails) for future reference.

Protecting Yourself: Preventative Measures

Prevention is always the best approach:

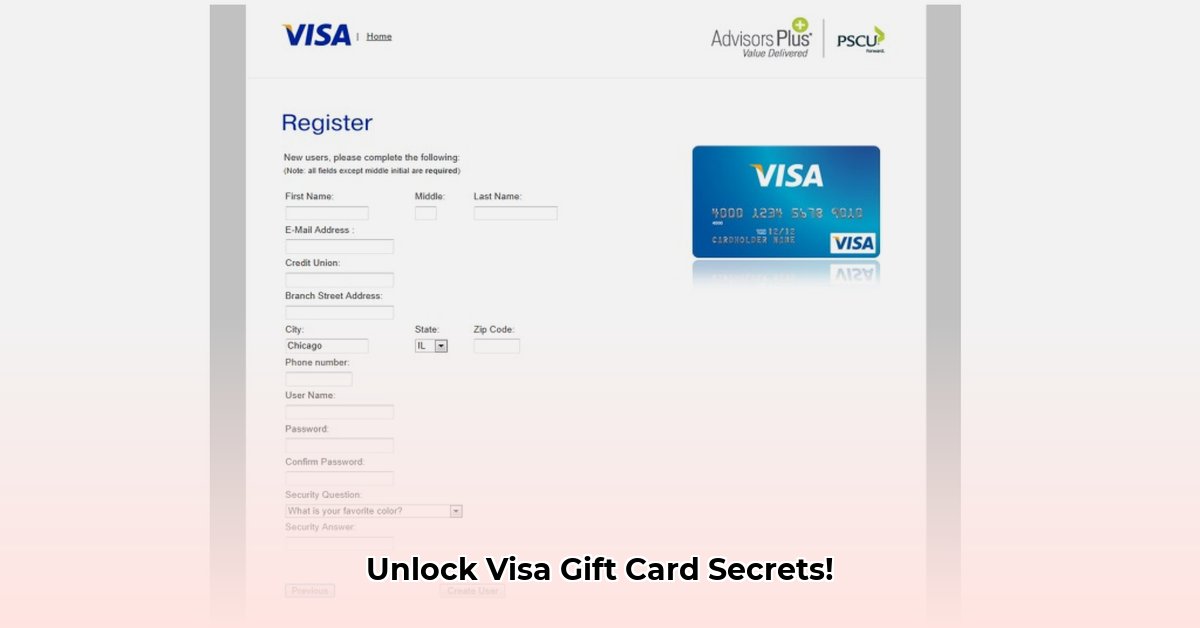

- Register Your Card: Registration (if offered) adds a layer of security and recovery assistance.

- Maintain Safe Storage: Keep your card secure and out of sight.

- Regular Balance Checks: Frequent balance checks allow early detection of unauthorized activity.

Further Questions?

While this guide provides a general framework, policies vary between issuers. Consult your card's terms and conditions or the issuer's website for specific details. Remember, responsible card use and proactive action minimize potential issues.